How is watchmaking doing? In spite of what some would have you believe, it is doing substantially well, as Morgan Stanley and LuxeConsult's recently released annual report showed. The new market is holding up undaunted with impressive sales numbers. The second-wrist one is keeping pace, ready to show its muscles in the not-too-distant future. Let's see together what's going on.

Also this year, Morgan Stanley and LuxeConsult, a consulting firm specializing in the watch industry, released their annual report on the state of the Swiss watch industry. The data confirm the trends already observed over the past three years:

- Market growing in value but declining in volume: the export value of finished watches reached CHF 25.5 billion in 2023, an increase of 7.6 percent over 2022. This new all-time high was partly driven by inflation, but even taking this factor into account, growth remains positive.

- Premium factors and sales polarization: the premium segment of the market continues to grow, while the mid- and low-end segment contracts. This trend is accentuated by sales polarization, with more and more customers turning to high-end watches and a decline in interest in cheaper models.

Other highlights of the report:

- Hermès remains the fastest growing brand: with a 13.8 percent increase in 2023, Hermès consolidates its leading position in the premium segment.

- The United States and China remain the main target markets, with both countries experiencing double-digit growth in 2023.

- Stainless steel watches continue to dominate the market: accounting for more than 70 percent of Swiss watch exports.

- Demand for vintage and secondhand watches remains strong-this trend is fueled by a number of factors, including the search for alternative investments and increased environmental awareness.

The Swiss Watch Industry: Between Record Sales and Future Challenges

The Swiss watch industry ended the year with an extraordinary result, totaling record sales of CHF 26.7 billion, with CHF 25.5 billion attributed to wristwatches, sold in 16.9 million units and marking a 7.7 percent increase. Although these figures initially seem very positive, the latest annual report published by Morgan Stanley and LuxeConsult provides a more detailed and nuanced analysis, revealing a reality split in two.

In Miami, during days organized by the LVMH Group, luxury industry executives got a close look at such notable pieces as Hublot's Big Bang model in brilliant green and TAG Heuer's new creation set with synthetic diamonds. However, the glitzy backdrop concealed more uncertain prospects for a usually resilient sector now forced to contend with a general slowdown in luxury spending and deflation from a pandemic-era boom that had sent resale prices soaring.

Watches of Switzerland, the UK's largest seller of Rolex, Breitling and Cartier watches, issued a serious profit warning in January, admitting that it had underestimated the impact of a recession in luxury, causing its shares to plummet. A few days later, the Swatch Group, the Swiss company that produces the luxury brand Omega as well as its eponymous plastic watches, missed its annual profit forecast and informed analysts that consumers in mainland China were favoring lower-cost items.

Arjen van de Vall, CEO of U.K.-based Watchfinder, which specializes in buying and selling used luxury watches and is owned by Richemont, said the boom in demand for high-end watches during the pandemic was a "once-in-a-generation event" now over, comparable almost to the likes of cryptocurrencies, and to some extent to whiskey and luxury cars.

The luxury watch market consists of retailers such as Watches of Switzerland and Bucherer, purchased last year by Rolex, as well as design houses such as Richemont and LVMH, which manufacture and sell their own brands. The so-called "holy trinity" of Swiss watch manufacturers consists of Audemars Piguet, Patek Philippe and Vacheron Constantin owned by Richemont, which sell through third parties as well as in their own boutiques.

Thanks to savings accumulated during the pandemic amid low interest rates, wealthy consumers stuck at home bought new luxury watches faster than Swiss manufacturers could make them, boosting demand for second-hand watches and pushing prices to new highs, benefiting both retailers and manufacturers. In the decade from 2013 to 2022, watches outperformed other collectibles such as jewelry, handbags, wine, art and furniture, growing in value at an average annual rate of 7 percent -- and 27 percent from 2020 to 2022, according to indexes compiled by BCG.

However, prices in the resale market for luxury watches have now fallen for seven consecutive quarters, having peaked in May 2022, according to data from Morgan Stanley and WatchCharts. The second-hand value of Rolex, Patek Philippe, and Audemars Piguet watches increased by an average of nearly 50 percent between the first quarter of 2020 and the same period in 2022, according to Matthew Clarke, senior watch merchandising manager at luxury second-hand retailer The Real Real. But in the last quarter of last year, these values plummeted by more than 20 percent.

Luca Solca, retail analyst at Bernstein, said, "The industry was caught off guard and there was not enough inventory to meet demand...[but] the situation in this regard is normalizing."

Even Rolex, which dominates the market, appears to be impacted as buyers consider purchases more carefully. Although it does not publish data on its prices and declined to comment for this article, according to Morgan Stanley the average price increase for a handful of Rolex models in the United States (a key market) has stopped this year for the first time since 2015. Meanwhile, the price gap between second-hand and new Rolex models has narrowed significantly from its March 2022 peak, moving to an average resale premium of 20 percent today from an estimated 90 percent, according to Morgan Stanley. The company also appears to be taking a more conservative approach to the production of its watches. Watches of Switzerland, which gets more than half of its sales from Rolex, said in January that it received more steel watches than the more expensive steel and gold variety, affecting its average selling prices. These dynamics are part of a broader context of slowing luxury demand that has spread from the United States to mainland China and Hong Kong-typically the largest market for Swiss watch exports.

Samuel Lee, honorary advisor to the Hong Kong-based industry body Federation of Hong Kong Watch Trades & Industries, said, "Neither Hong Kong's nor mainland China's economy is doing very well. With a weak renminbi among other factors, consumers today are more careful about how they spend their money. The margin between retail and secondary market prices is also shrinking--now with a lower expected value, people are becoming more cautious when making a purchase. Many buyers don't really expect value appreciation, but rather choose the pieces they really like for their own use."

Meanwhile, LVMH, which owns watch brands including TAG Heuer, Hublot and Zenith, reported that watch and jewelry sales rose 7 percent on an organic basis year-on-year in 2023, compared with a 12 percent increase the previous year, echoing a broader slowdown in demand.

But according to analysts, watches will remain resilient as a store of value. A recent report by McKinsey and Business of Fashion predicts that jewelry and watches will gain a share of discretionary luxury spending over the next four years, while "ready-to-wear" will slow, noting that "durable goods are more likely to hold their value in an uncertain economic environment." Meanwhile, Nick Hayek, CEO of Swatch, said a slowdown in prices for used watches is a healthy dynamic for the industry, marking the end of a speculative bubble. "This is not a decrease in demand for luxury. People will always love an authentic brand," Hayek said, "The problem arises when speculation comes into play...People bought what they could get, thinking...that they could always sell it if necessary and [get] a higher price."

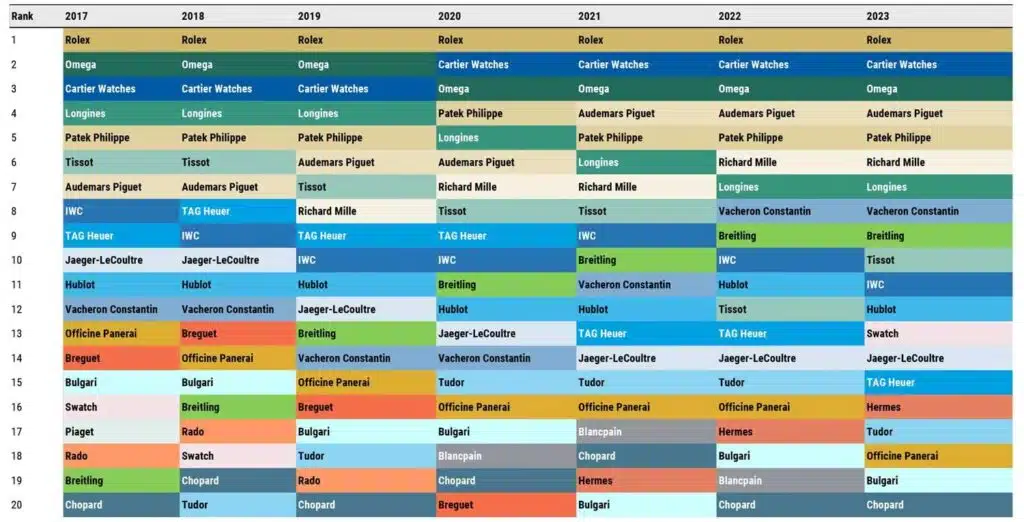

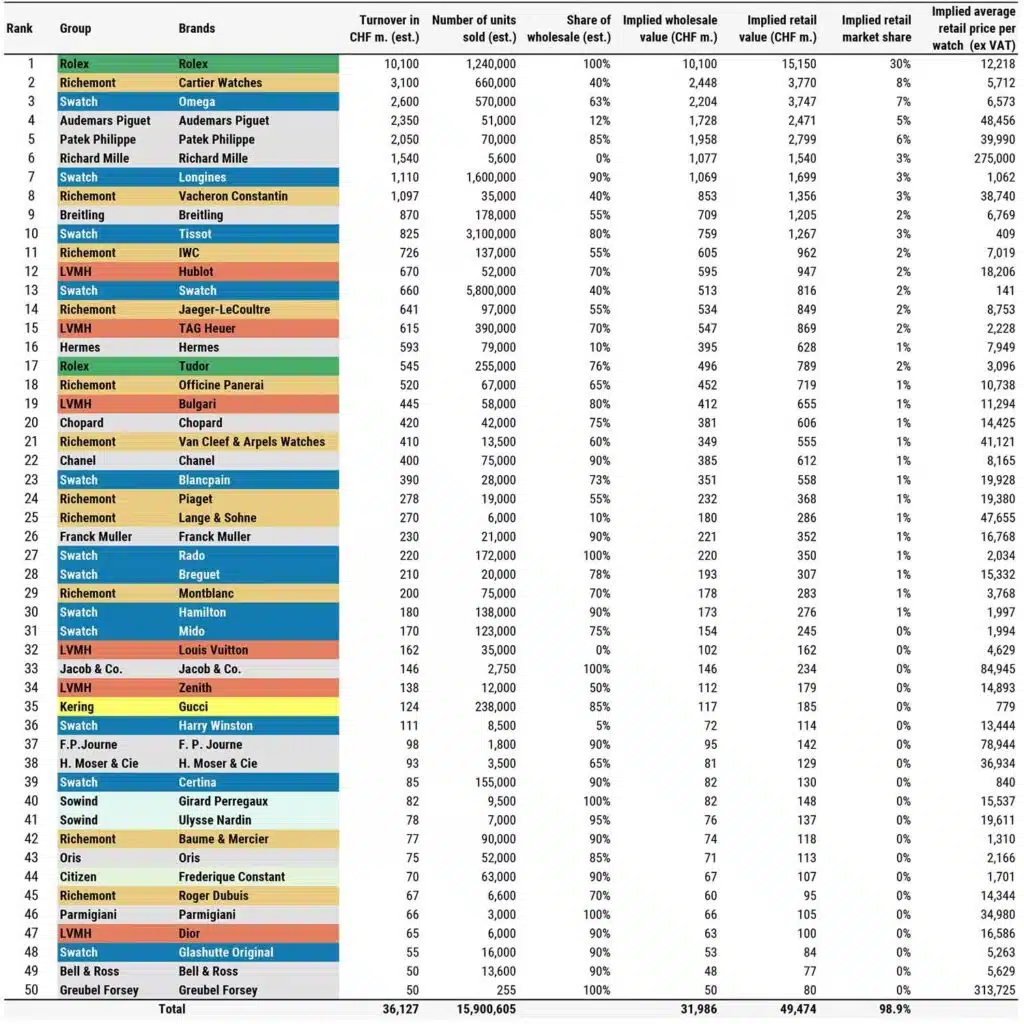

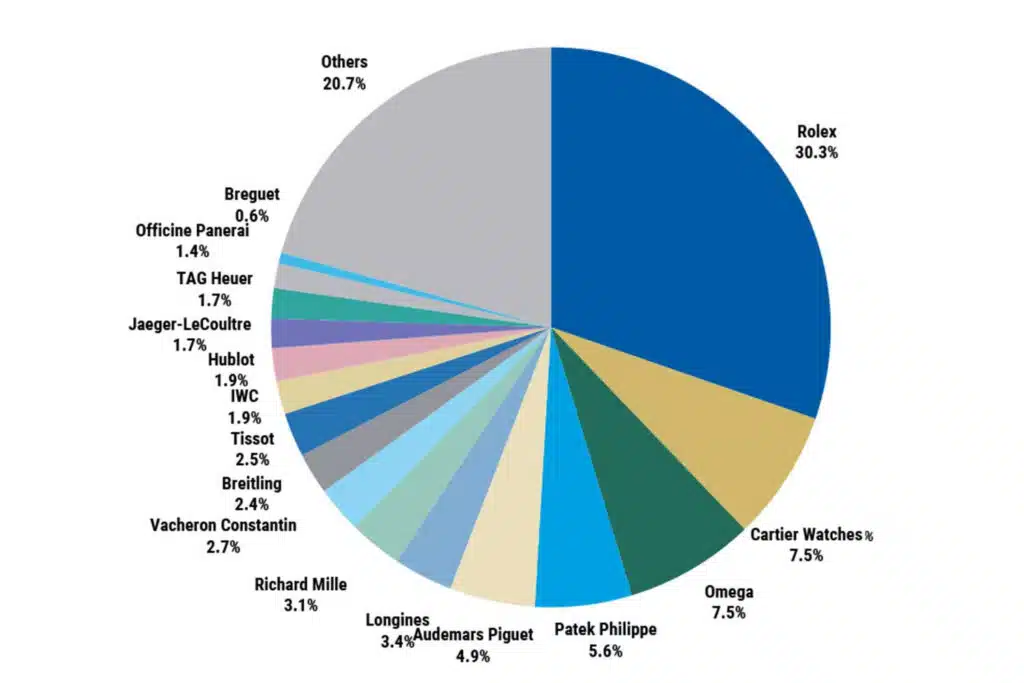

The dominance of the "Big Four" luxury watch brands - Rolex, Patek Philippe, Audemars Piguet, and Richard Mille - has strengthened, gaining +203 basis points and securing significant market share. This acceleration of a long-term trend becomes evident when compared with pre-Covid 2019, with an increase of +693 basis points from 36.9 percent in 2019.

Swiss watches: estimated market shares by brand in 2023

Rolex made history by becoming the first Swiss watch brand to surpass the CHF 10 billion mark in sales. It also strengthened its dominant position in the market, capturing a remarkable 30.3 percent share of the retail market. No other luxury brand can boast such a dominant presence in its product segment.

Vacheron Constantin enters the billionaires' club as the 8th brand to surpass CHF 1 billion in sales, reaching CHF 1.097 billion with an 18 percent increase. In addition, the brand gained an increase of 24 basis points in market share. However, with a retail market share of 2.7 percent, it still lags behind its direct competitor Patek Philippe, which stands at 5.6 percent (+32 basis points).

Within Richemont, the performance of specialized watch manufacturers has varied, with three brands - Vacheron Constantin, A. Lange & Söhne and Van Cleef & Arpels - gaining market share. However, a significant concern for the division is IWC, which experienced a 13 percent decline in sales, estimated at CHF 726 million. This decline is attributed to the brand's increasingly misplaced price positioning, despite the launch of interesting new products, such as the relaunch of the Ingenieur watch. Retail prices remain ambitious, with direct competitors such as Omega and Breitling offering more competitive value propositions.

Cartier watches slightly underperformed jewelry, recording an 8 percent increase in sales to CHF3.1 billion, compared to the 11 percent increase in jewelry. However, they outperformed the industry average and gained market share by 5 basis points. For the first time, Cartier's retail market share surpassed Omega's, reaching 7.54 percent compared to Omega's 7.49 percent.

Rolex, Cartier, Omega, Audemars Piguet and Patek Philippe lead Swiss watch sales, showing a significant dominance of only four brands, which together contribute 50.2 percent of total sales. Moreover, only thirteen brands span 75 percent of the market, while 90 percent of Swiss watch sales are attributed to only twenty-five brands out of about 350 in total.

Despite an overall decline in market share (-75 basis points), the Swatch Group saw remarkable success in two areas. Swatch experienced a remarkable 55 basis point increase from #22 to #13 in 2019, largely due to the continued popularity of the MoonSwatch, which sold over 2 million units last year. This success accounted for 73 percent of the brand's sales, totaling CHF 660 million, marking a remarkable 63 percent year-over-year increase, the largest gain among all brands in the top 50. In addition, Tissot's recovery was fueled by the success of the PRX product family and the reopening of the Chinese market. The premiumization trend continues unabated, with watches priced above CHF 25,000 driving 69 percent of growth and accounting for 44 percent of the total value of Swiss watch exports. However, despite its significant contribution to value, this segment accounts for only 2.5 percent of the total volume in units.

The Swatch Group is the largest volume contributor in the entry and mid-price segments, holding an overall volume share of 72 percent. While the entry point continues to be influenced by smartwatches (among other factors), about 80 million advanced smartwatches were sold worldwide in 2023 (about 140 million in total), compared to a total of 16.9 million Swiss watches exported last year. Swatch and Tissot are the two exceptions defending this price segment of traditional watches against smartwatches, fashion brands and crowd-funded micro-brands.

Among the key winners in 2023, the major privately owned brands - Rolex, Patek Philippe, Audemars Piguet, and Richard Mille - continued to gain market share. The luxury watch market stands out from all other luxury segments, where listed groups and brands lead their respective product categories.

Among listed companies, the performances of Hermès, Vacheron Constantin (a subsidiary of Richemont) and the Swatch brand (a subsidiary of the Swatch Group) were noteworthy, with the latter growing +63% after a year-on-year gain of +90% in 2022, making it the fastest-growing Swiss watch brand among our "top 50" in 2023 for the second consecutive year.

However, there were also losers in 2023. After extraordinary revenue and profit growth since its acquisition by a private equity firm in 2017, Breitling's conquest of the premium segment has temporarily stalled. The brand has barely achieved growth in 2023 with only 1 percent more in sales and even a decrease in volume (-4 percent). But competitors (apart from Omega, which achieved a remarkable +4%) had an even worse year, with TAG Heuer down -7% and Tudor down -4% after years of uninterrupted growth.

Other listed groups: a mixed performance.

We estimate LVMH's market share declined by losing -68 basis points to 5.8%, down -191 basis points from 2019. Hermès sales posted solid growth of +11% in CHF (+23% in € at constant rates) and gained two positions to become #16, gaining +7.3 basis points in market share.

The year of independent brands.

Let's start with a question: what is an independent brand? Basically, it is a manufacturer that has no affiliations with a luxury group and is neither listed nor institutionalized. This last detail is important, because in theory Rolex, Patek Philippe, Richard Mille.... could also be defined as "independent." Given these premises, the brands can be very different in terms of both sales and market positioning.

Brands such as Richard Mille, Girard Perregaux, or Ulysse Nardin would not be considered independent given their institutionalized status-as well as the fact that for some they are totally or partially controlled by institutional or private investors. FP Journe is in an intermediate position, as Chanel controls 20 percent of the brand's capital, but the Maison FPJ has maintained the independent spirit.

Last year saw tremendous growth for these brands and for the first time since we began our ranking, we are seeing three independent brands integrate the top 50 with FP Journe ranked #37 (CHF 98 million), H. Moser & Cie #38 (CHF 93 million) and Greubel Forsey #49 (CHF 50 million in sales).

Although the economic importance of the aggregate sales of these 40 or so brands is rather anecdotal, with less than 2 percent of the Swiss watch industry's total sales, their creative initiatives have had an impact on institutional brands. Wealthy watch collectors are always eager to discover new brands, new stories, and rare watches. They are watch buyers capable of purchasing more than one watch per year with a price tag of more than 50k CHF.

Growing faster at the revenue level allows brands to capture more margin-this is the magic virtuous circle of gaining additional market share and becoming more profitable. The "Big 4" are not only continually increasing their market share (see above), they are also becoming more profitable. The revenue pool shows a 45% share taken by the leading brands, which translates into an extraordinary 63% share of the industry's profit pool.

Hermès has shown its competitors what strategy must be applied to succeed as a luxury brand in the watch industry. The brand must align each product category with the overall brand positioning, unless it considers some of them as aspirational products, such as perfume. Hermès therefore decided to shift gears and moved into mechanical watches, significantly increasing the average selling price. Hermès showed impressive growth through this premiumization strategy, which also included shifting mainly wholesale sales to its own retail (90 percent in 2023).

It is worth mentioning that rival Louis Vuitton is also following the same path, phasing out the entry level, mainly basic quartz and mechanical movements, and pushing manufactured movements to a much higher price level. The launch of the new Tambour at a retail price of CHF19,000 with a three-hand watch shows that the brand aspires to become a collector's watch. Due to the change in strategy, the brand remained stable on sales last year, but early results show excellent sales rates in Louis Vuitton stores (100 percent in directly operated stores).